src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

Was looking at the Gold forward lease rates from the London Bullion Market Association (LBMA) website (you can look yourself here if interested). It looks like the 1 and 2 month lease rates have inverted for the past three trading days in a row. When you start getting into lease rates, my brain has to keep things simple so that I don't get confused. I am no Antal Fekete.

The bottom line is that when the 1 month lease rate is higher than the 2 or 3 month lease rate (the opposite of the normal situation), this can be significant. When such an anomaly only lasts for a day, it is rarely significant. When it lasts for several days in a row, it generally means significant physical Gold market tightness and suggests a pending up move in the Gold price to alleviate the shortage of physical metal and/or satiate an elevated demand for physical Gold. Is it more complicated than that? Yeah, I'm sure it is, but I can't keep up with all the nefarious paperbug schemes to sell and lease Gold one doesn't actually own and make it seem like it's a normal thing that shouldn't alarm anyone. I'm sure Nadler over at kitco.com could tell you why it is bearish for the Gold price right here and right now.

The last time a string of at least 3 days in a row of "reversed" Gold lease rates occurred in the two front months was during the early days of the Great Fall Panic of 2008. Many wanted physical Gold but there was little to be had at the advertised paper price during the panic. Gold crashed in the panic and then was right back at $1000/oz before February was over - this recovery was in a sense "telegraphed" by the long daily strings of reversed lease rates right through the fall 2008 lows in the Gold price. Prior to the fall of 2008, the last string of at least three days in a row of reversed Gold lease rates by the LBMA's measuring stick was in November and December of 2007, right before the move that took Gold from $800/oz to $1030/oz in early 2008. These strings of days with the lease rates reversed were extended in length during the Great Fall Panic of 2008 and also during the November 2007 to March bull run (even lasting into April of 2008 in the latter case). I don't claim to know what will happen next this time around with the lease rates, but I'll be watching.

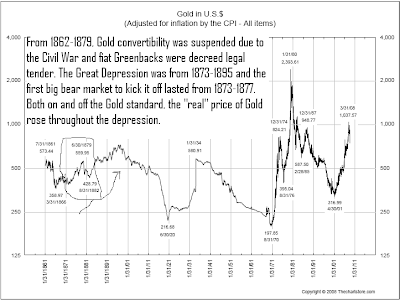

Like any other data, this is only one piece of a puzzle that fits with my bullish view on Gold. Physical market tightness, reversed lease rates, poor sentiment in the Gold patch (evident due to weak public and hedge fund participation), a U.S. Dollar that is significantly overvalued relative to other colored paper debt tickets backed by nothing, a healthy correction in price, and even the negative comments I am starting to get from blog readers and others who email me convinced Gold is headed even lower because their chart analysis says so. I remain bullish and unconvinced by their bearish arguments, despite always wanting to hear from the other side why I am wrong. Call me stubborn if you want, but I still think Gold is going to surprise the majority of current market participants by blasting to a new high before the spring is over and I still think Gold stocks will outperform during this pending bull run that may have already started.

Newmont Mining (ticker: NEM) is already up about 19% off the February lows and looks to be quietly leading the Gold stocks higher. It was up significantly today despite a down day for the price of Gold. Freeport McMoran (ticker: FCX) is a copper and base metal miner that also mines Gold and made new highs today for the early uptrend that began with the early the February bottom (don't ask me why FCX often leads the Gold patch higher in the early stages of a move but it does). Of course, I placed bets with Goldcorp (ticker: GG), Yamana Gold (ticker: AUY) and the GDX and GDXJ ETFs, so this early strength by these two blue chips doesn't help me much financially but I still consider it a good sign.

I remain as biased as ever because I have already put my money where my mouth is. I can only hope to get another pay check in time to buy more stocks in the precious metals patch before the next move higher really gets going. Until the Dow to Gold ratio hits 2 (and we may go below 1 this cycle), I will become wildly bullish after every Gold price correction. Dips are buying opportunities in the Gold patch and this time will be no different.