I was wildly bullish on Gold stocks during this winter and spring. I am now in watchful waiting mode, waiting to accumulate Gold stocks at a cheaper price. I have been more focused on shorting the S&P 500 over the last few months, but I watch the Gold sector every day.

I don't trade physical Gold, but I am always looking to accumulate more on weakness if I have cash on hand. I don't own Gold miners, I trade them. I don't think buying and holding Gold miners is a bad idea at all this secular cycle, but I have chosen to buy and hold the Gold sector via physical metal and to trade the Gold sector using the miners. It is a personal choice, as we all must make when investing and managing our own money.

I "gave up" on the long Gold stock trade in May, when Gold stocks failed to show the strength relative to the metal price that I thought they would be showing if we were on the verge of a major cyclical bull thrust higher. I am bearish on equities in general, but Gold stocks can move higher despite a falling general stock market and have many times in the past. I am more concerned about the Gold miners' lack of relative strength compared to the Gold price than I am about a stock bear market.

I

created my own thesis and "road map" for the anticipated Gold stock (as a sector) correction back in May. Since that time, the major Gold stock indices (i.e. $HUI, $XAU, GDX) have made a kind of triple top formation, while the junior sector, using GDXJ as a rough proxy, has broken about 5% higher than its May highs. In other words, pretty much sideways action, but the sector has not yet corrected as anticipated.

The point of corrections is either to "scare you out" (i.e. price plunge) and/or "wear you out" (i.e. take a long time moving little in either price direction). Of course with Gold stocks, even a "wear you out" correction can have 10-30% swings in either direction. C'est la vie in the Gold patch.

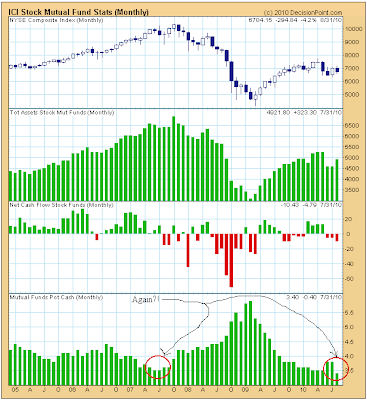

Only time will tell if my anticipated correction in the GDX ETF down to the 40 level will prove correct. For now, I am watching and waiting for a better opportunity in the Gold stock sector. Why? Because Gold stocks are still underperforming the Gold price, and this is corrective-type action in my opinion. Couple this with my uber-bearish outlook on the stock market right now and I continue to believe that Gold stocks are headed for a significant correction. This is not a bearish outlook, this is cash on the sidelines looking for a better entry point. I may get it, I may not (such are the risks of speculating). If I get it, I will be betting the family farm from the long side using long term LEAP-type options on GDX and potentially on a few individual miners. I also plan to go long GDXJ as well if I get my anticipated correction, but to a lesser extent since this ETF doesn't offer long term options.

Here is the chart that keeps me from being bullish on Gold miners right now, a 2 year daily chart of the $HUI mining index divided by the price of Gold (i.e. $HUI:$GOLD ratio chart):

This analysis is irrespective of the general stock market and stands on its own. Couple this with a "toppy" looking Gold chart (1 year daily $GOLD candlestick plot):

For those who can't see how Gold could possibly correct here, have you seen the latest Commitment of Traders chart for Gold futures (if not,

check here)? Lots of paper chasin' momo hedgie quants in on the "long paper Gold" trade right now, just waiting to hit the sell button at the first sign of trouble.

I remain wildly bullish on Gold and Gold stocks for the long term. I remain wildly bearish on equity markets for the intermediate term. I remain in bored and watchful waiting mode when it comes to the Gold patch for the short term until I see a meaningful correction, which I am thinking (hoping?) will complete before the year does.

![[Most Recent Charts from www.kitco.com]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_uKhU0IvqXf0y0oa7VoR8w8KPOEIq5evJ2wnoZTEsB7A4xS1XATYXS3o6fzXY17OcrkJDvI2GqHgxXQhcS4cj0VeqNkdYEjTxWCxHpVnq3hiiwnGv2yQVQmcZ1_5GVg6QHlDQ=s0-d)