The Euro debt crisis and the US Federal debt ceiling malarkey are the center of attention right now. Despite what you read, these are already priced into the market. Amazingly, it's been mostly a yawn so far, but I don't expect this to last. However, it is often something out of left field that scares the market into a new bear cycle. It could be Danish banks failing or the area I have been watching - a municipal bond implosion in the United States. I was recently looking for a top in the muni bond market and I think we may have just gotten it. Here's a 6 year weekly chart of the $MUNP muni bond ETF price return index thru today's close:

This ain't a bullish chart, folks. How many straws does it take before the camel's back breaks? If the US monetizes the muni debt, the Dollar could go into a tailspin. If not, we are headed for another deflationary wave in line with the 2008 fiasco. There are no good solutions, only tough choices that will be painful on main street.

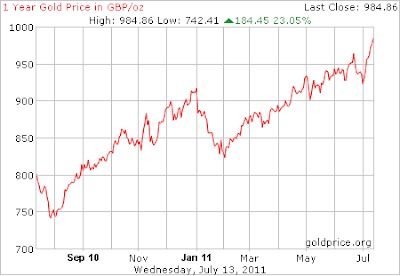

The Dow to Gold ratio broke down this week and is set to make new secular lows, almost certainly before the year is over. Physical Gold holders continue to become significantly more wealthy in common stock terms, simply by buying and holding a so-called shiny piece of worthless metal. History repeats right in front of our eyes but paperbugs still refuse to believe it. Here's a weekly log scale 5 year chart of the Dow to Gold ratio ($INDU:$GOLD) through today's close:

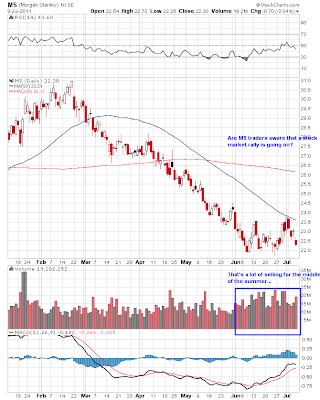

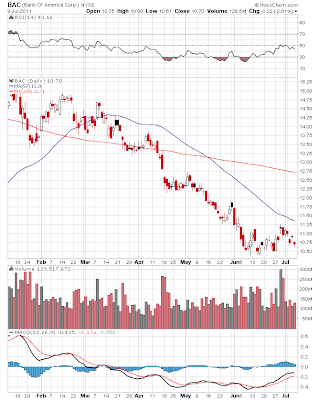

I can only smirk when the commentators who never saw the latest Gold rally coming are falling all over themselves to call the "imminent" top in Gold. Keep calling. I'll stay long for now in my trading account. And when the time comes, my subscribers and I will be shorting the $%&#@ out of this pig of an equity market. Specific short-term trading recommendations are reserved for subscribers. My long-term investing recommendations have been consistent for years: avoid common equities, avoid real estate, avoid paper currencies, and avoid government bonds and buy physical Gold (and a little silver) and secure it outside the banking system.

The scoreboard is getting a little lopsided in favor of those "crazy" Gold bulls, but that doesn't mean the paperbug financial massacre is coming to an end. Actually, it's going to get worse this fall. I'm sure Krugman will blame it on not enough stimulus and individual mistakes within our colossal and ineffective government, but I'll just stick with basic long-term cycles that repeat over and over. To be honest, I'm not at all bearish on the US Dollar right now relative to other paper currencies. But trampoline jumping ignores the basic premise that will sustain those willing to use common sense and ignore mainstream advice: all paper currencies are sinking relative to Gold and will continue to do so until the Dow to Gold ratio hits 2 (and we may well go below 1 this cycle). Long after Bernanke has retired or been run out of town and long after the US Dollar ceases to exist in its current form, Gold will be money. Cash is king during a bear market and Gold is the ultimate form of cash for this secular cycle.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)