Saturday, February 28, 2009

Playing in the casino

is very different than building a core base of wealth. The era we are in is one of financial destruction where paper promises are revealed for the fraud they have become. I try to time markets for short-term profits only so I can turn those paper dollars into physical gold. The casino is rigged and many of the counterparties involved are now insolvent and desperate.

If you have not yet turned 10-50% of your liquid net worth into physical gold, you better get going and stop worrying about exact timing. Yes, the U.S. Dollar has held up well and will continue to do so for a time as the deflationary wave intensifies. However, this is an opportunity to diversify out of the dollar into the only asset class in a sustainable bull market - gold.

Gold will outperform the U.S. Dollar over the longer run (years), because the U.S. Dollar is in trouble over the long run. You can argue all day about the dollar versus the yen or euro, etc., but this is a fool's debate in the long-run. All paper promises are sinking relative to real money. Short-term trading is playing in the casino and those who are good at it can make some extra paper to be turned into something of longer term value.

As I have said before, investing is a relative value game. If the debate is between stocks, real estate, commodities or cash for longer term (3-5 years) investors, that's an easy debate. Cash will outperform the other asset classes, but only if you are in the right form of cash. Gold is still the best form of cash and the only reliable one on a long-term basis.

People who dislike gold are those who have fallen for the bullshit conventional wisdom that comes from JP Morgan, Goldman Sachs, and every central bank and government in the world. These behemoths are the people who profit the most from a fiat paper money system and need the sheeple to remain ignorant so their con game can continue. If we are talking 3-6 months, sure old Uncle Buck may outperform gold, but if we are talking the next 5 years, gold will trounce the dollar and the dollar may not even exist in 5 years.

Holding physical gold is not the same as holding the GLD ETF. Mark my words: before this secular bear market is over, the GLD (gold) and SLV (silver) ETFs will be exposed for the fraud that they are. They do not hold the gold or silver they say they do and these ETFs are destined for failure, as are many ETFs. I use ETFs as short-term trading vehicles for now, but there will come a time soon when it won't be worth the counterparty risk for many ETFs other than for intraday trading.

Yes, of course the capital markets will survive, but Madoff-like scandals will wipe out whole ETFs and zero out their holders in one fell swoop. The government will probably step in and make the investors involved whole, but this is not guaranteed. Bank failures and market maker failures are absolutely an important part of this bear market and we ain't seen nothin' yet.

So, while I play in the casino for paper profits, I know that paper profits are fleeting and temporary. The more I make, the more physical gold I can buy. And until the Dow to Gold ratio gets back to 1 (or lower), this bear market in stocks is NOT over.

For those who think gold is primarily an inflation hedge, you are largely incorrect. Gold is a better deflation hedge than inflation hedge. Gold performs better as money than as a commodity. We had plenty of inflation in the 1990s and 2000s, but gold didn't do well. Inflation moves around from asset class to asset class, and gold moves in and out of favor during inflationary periods. During deflationary credit contractions, gold is one of the only places to hide to preserve wealth and eliminate counter-party risk.

If you think the U.S. government and international banks don't present a counter-party risk at this stage of the game, I don't think anything I say in this blog can change your mind. You have drank too much of the Kool Aid and I wish you only the best, though I fear the worst when it comes to your long-term financial health. Just don't say you were never warned...

Thursday, February 26, 2009

Going DOWN!

Short-term trader plunge alert! The next week is NOT going to be pretty for the bulls. For my bearish brethren, the cash register is going to start ringing. There is too much complacency and too little fear as we re-test the panic fall lows, thus, we will smash below them with a vengeance.

The $VIX and $CPC (put to call ratio) tell the story in the charts. These charts that follow are busy, but the basic issue is simple: when lows in a bear market are re-tested, fear (i.e. $VIX) and the short ratio (i.e. $CPC or $CPCE) should both increase in order to cement a lasting bottom so that an intermediate advance can occur. This is not what's happening, so we'll keep dropping from here. Period.

Here's a $VIX chart from recent history (2 year daily chart):

Here's the last cyclical bear market within this secular bear (2000-2003 bear):

Here's some summation index action ($NYSI) relative to the S&P 500:

I am also very concerned (or, as someone who is short, should I say excited?) about the put to call ratio, a measure of sentiment related to what people are actually doing with their money (i.e. action, not talk):

Bottom line: I remain confidently short. Bulls beware, the panic wash-out ain't even started yet! A 10% drop/rinse from here is not an unreasonable proposition and should finally get the bulls to shit their pants so we can have a decent rally into the spring. Think 1937-1938 (apologies to Institutional Advisors for the chart theft):

$$$$ drop from the helicopters straight ahead for the bears...

Tuesday, February 24, 2009

Trading on top of big picture fundamentals

There is trading, there is longer term investing and there are fundamental underpinnings of investing. I like an approach that recognizes all three. Underlying fundamentals are important to understand as an investor, because they tend to cause the underlying long-term moves, though stocks often lead or lag the fundamentals. Trading relates more to technical analysis and timing of surges in the direction of the major trend and pullbacks against the trend.

Not exactly new information, I know, but I always like to re-visit and keep an eye on the big picture. Here are the fundamental facts as I understand them:

1. We are in the midst of a deflationary credit contraction, the size and ferocity of which will rival (if not surpass) the last so called "Great Depression."

2. We are not yet close to the bottom of the current cyclical bear market, which is occurring in the context of a secular bear market that began in 2000.

3. The only "long-term" (i.e. measured in years) safe havens in this storm are cash and cash equivalents (e.g., gold and short-term U.S. Federal government bonds) and gold mining stocks.

4. The deflationary credit contraction cannot stop until all the bad debts are purged from the system. As long as the credit system is contracting and unstable, inflation and economic growth are highly unlikely to occur.

5. The banking system in the U.S. and Europe is insolvent. Bankers, the credit dealers in our economy, cannot perform their role of extending credit until they become solvent/stabilize. Until housing and commercial real estate prices stabilize, it is not reasonable to expect the banking system to stabilize. Housing and commercial real estate prices are not yet close to stabilizing.

For those who don't like to trade, this is all you really need to know. There are a few significant real world applications of this general knowledge:

1) If you leave your life savings in general stocks, you will lose most of your life savings.

2) Don't buy real estate (or invest in real estate-type vehicles).

3) Cash and gold held in an arrangement that eliminates counterparty risk are the best investments for safety and gold mining stocks are the only sector of the economy in a bull market, as deflation is wildly bullish for gold miners.

Sometimes keeping things is simple is better, no? And yet, most people are leaving their money in the stock market like good little sheep, out looking for real estate "deals," and smirking along with CNBC commentators when gold is mentioned.

A final steep leg down in blue chip gold mining stocks began today. This tells me that the quick, deep gold price correction I have been waiting for is now underway and should only take 2 weeks or so to complete 90% of the move down - patient potential buyers get ready. I also suspect this leg down in blue chip gold miners won't take long and will provide the buying opportunity for which I have been patiently waiting. The miners will bottom before the gold price, so don't rush to buy gold too soon until you see the gold miners stop dropping.

My favorite blue chip gold mining stock is Goldcorp (GG). This stock should now be in its final 1-2 week leg down in a correction that began almost 2 months ago. The base being created by this stock for a spring launch has me extremely excited. I will be betting the farm on this stock soon.

Here's a current chart of GG:

Here's an example of typical similar prior GG stock price action during last year's bull run (2007-2008):

And here's what happened next in 2008:

Now folks, a 40% gain in 2 months is more than enough for me in a stock. And, since I use options, this is likely to be a potential 80% (or more) profit opportunity if history rhymes and it should only take 4-8 weeks to make that kind of gain. Also, please don't think the example in the charts above from last year's bull move is unusual for GG!

I'm going to be busy until early next week and posting will be quite sparse - happy trading...

What do you mean, bullish?!

I'm looking at DIG, the double bullish ETF on oil and gas stocks, and thinking about what comes next once this panic wash-out blows over. At $20/share for this ETF, I think an easy 50-100% gain can be made within a few months on the bear market rebound. Oil went from darling to red-headed step child in the blink of an eye, but every collapse is followed by a decent dead-cat bounce and the one in DIG, given its double leverage, should be fantastic.

Since I believe we may be in the final week of yet another intermediate bear market leg plunge (roughly 21% so far over the last 7 weeks), it's time to start planning for what comes next. I think DIG is as good an ETF sector play as any for a wicked bounce higher as a short term trade to be held for 2-8 weeks. Don't be in a rush to buy too soon, as this thing could hit $15 if the final plunge turns ugly. However, at under $20/share, I think DIG is a lock for a relatively quick, very profitable trade.

Monday, February 23, 2009

Patience

is not a virtue of mine or most traders. As an example, I got into KSS (Kohl's corporation) April puts back on 1/26/09. I have been in this trade less than 1 month and I am sitting on 40% gains, but it feels like it is taking forever for this stock to do what I expect/want. I have also been impatiently waiting for gold stocks to slide into a routine steep correction for a while now, but they have been holding strong for an entire 3-4 weeks while I wait.

Knowing how and when to "sit on your hands" or "sit tight and be right" is a hard lesson to learn and must be balanced by the need to abandon an unsuccessful trade when wrong. I know many have expressed to me their anxiety waiting for the gold price to correct, as everyone is afraid of missing "the big move." Trust me, the patience is worth it. In trading, as in life, some big opportunities will pass you by. However, if you wait for the fat, slow pitches before swinging for the fences, the wait is generally worth it.

I couldn't resist the opportunity today and added some more Autozone (AZO) June puts to my collection at the open. I also dumped my PAAS silver miner puts today at a small profit (not as big as I had hoped...). We are getting closer to a bottom and I don't think we will go much more than 10% below the November lows in the S&P 500 before a big rally occurs. Remember my 3 "triggers" that must occur before I start thinking about going long in anything besides puts:

1. RSI near the 30 range on a daily chart of the S&P 500 (check - this one's done)

2. Equity put to call ratio ($CPCE) at/greater than 1.10 on a daily chart (not there yet)

3. $VIX greater than 55 (not there yet)

Don't chase silver or gold here from the long side and don't be a brave bull too soon in general equities. Wait for a fat, slow, sweet pitch. We should have a nice capitulation bottom before it's all over, and I'm guessing it will occur before the week is over. Don't worry about missing the bull train, worry about getting flattened by the bear steamroller. If you are short, it's time to start setting profit goals and then either closing trades once they reach the objective or using stop losses to protect profits.

Sunday, February 22, 2009

Silver

Is something I haven't written about before. I prefer gold over the other precious metals, in part because it is the precious metal of choice in recent monetary history and is held by central banks around the world. When the poop really hits the fan, central bankers can simply declare by decree that the gold they hold is worth a boatload of paper dollars/promises. Get the end game? Instead of villifying gold, they will finally come to embrace it and use it to their advantage.

Silver is a bit of a schizophrenic precious metal, as are platinum and palladium. I say schizophrenic because it is both an industrial and monetary metal in history. Silver has a much longer monetary history and general track record compared to the platinum complex metals. I hold some physical silver as a small percentage of my portfolio. This is a core, long term holding with a time horizon of years (decades?). One of the reasons I am not as enthusiastic about silver is due to its past price behavior during credit contraction-type depressions. The best example is the last one we went through in the United States, the so called "Great Depression."

Below is a chart stolen from the Long Wave Analyst (great site and analyst by the way):

Silver also didn't do well during the previous credit contraction induced depression that started in 1873. Since history doesn't always repeat but it does rhyme, I am concerned the same thing will happen to silver this time.

Now, silver also has a few bullish things going for it and, remember, I hold a little.

1. Physical metal shortages are obvious on the retail investor side and there is a premium above spot price that is now chronic. This is an alarm bell not to be ignored.

2. The concentrated short position in silver (as with gold) on the futures market (see Ted Butler's work) is insane.

3. Silver is the "poor man's" gold and will be useful for bartering and daily transactions if our society has a significant monetary breakdown.

4. Silver has been in backwardation for an unprecedented one month now.

On the last point, see Antal Fekete's work, as he is an amazing voice of reason in the fiat wilderness.

So I prefer gold, but I understand the bullish case for silver and if it drops low enough during this deflationary wave, I will likely buy some more to be used both as a long term store of value in lieu of fiat cash equivalents and as an investment with explosive upside potential.

Decrease the deficit?!

Is a headline I saw on Yahoo! this morning. Needless to say, I am just a tiny bit skeptical. You see, what's coming next in the economy will not allow it. As job losses and foreclosures accelerate, the tax base dwindles. Bye, bye capital gains tax revenues, income tax revenues and corporate tax revenues. Hello, increased entitlements for those who lost their job or turn 65 in increasing numbers and ask for their Social Security and Medicare benefits.

As we decrease troops in Iraq, we increase troops in Afghanistan, so this one's a wash. As more and more "stimulus" is needed for a sclerotic, shrinking economy, more deficit spending will be promoted as the only available cure.

The only remedy available to Obama, since it makes no sense to cut government jobs while creating new government jobs, is to tax the rich. This won't be nearly enough to close the gap and also will discourage small business owners, thus worsening the jobs situation and eliminating any hope of new job creation in the private sector. The deficit will absolutely explode over the next few years. The promise to decrease the deficit will be rescinded as the economic crisis worsens.

Keep in mind as well that when things get really bad, a 401(k)/IRA/403(b) confiscation will probably get thrown into the works, so protect yourself accordingly. It will be sold under the guise of protecting us, much like the War on Terror and the War on Drugs. Don't say nobody warned you...

Saturday, February 21, 2009

Shiticorp and Skank of America

As Bill Maher called Citigroup (ticker: C) and Bank of America (ticker: BAC) the other night on his HBO show. Anyone who follows mainstream media investment shills and advisors needs to permanently learn their lesson with these two banks. Anyone who thinks these banks will survive in their current form and represent a good buying opportunity at current levels is unqualified to be an investor. Anyone who recommended these companies back in the spring, summer or fall of 2008 is also unqualified to be giving investment advice. Period.

The charts of these companies explain that the true, free market value of these banks is going to zero.

First a 3.5 year chart of Bank of America (daily, log scale):

Next, a 3.5 year chart of Citigroup (daily, log scale):

Want to see a recent historical example of a death spiral chart and what happens next? How about Fannie Mae (FNM):

This type of death spiral in a stock chart tells you what's coming next just like the fall crash in general markets told you what was coming next in the economy. During this time in the late fall, most of the assholes in the mainstream media were saying to wait for the Christmas season and that the unemployment rate wasn't that bad, Bernanke was acting quickly to "save" the economy, and blah, blah, blah. Meaning: the economy is fine and it and stocks will bounce back.

So, my question is this: why do people still watch television or read mainstream sources like Bloomberg, Barron's or the Wall Street Journal to get information on the economy when they never seem to see trouble in advance? Their line is the industry line: "now is the time to buy" and their line is the same every day, day in and day out, other than maybe to argue which "hot" bubble sector into which you should put money.

The other point is that chart reading or technical analysis is an important part of investing and a critical part of trading. The charts of banks tell you to stay away. These are secular turns in the banking sector, not cyclical turns. The banking landscape will be radically altered soon in the United States (and many other parts of the world).

Citigroup and Bank of America are done. Period. No one who knows how to read a chart would come to any other conclusion. It doesn't matter what Obama, Bernanke, Geithner, Cramer, Ben Stein or any of these people say. Their job is to maintain confidence and/or bring in ad revenue, not tell the truth.

So, perhaps, we may not nationalize Citi or Bank of America in name, but it's take them over, shovel trillions of dollars of welfare money into them, or watch them turn into dust. Either way, they are insolvent and non-viable corporations. In a true free market (which we have not had for quite some time), these companies would have already had to declare bankruptcy and would no longer exist. Only the most skilled of day-traders should play in these stocks, and then, only for short-term scalp-type profits.

But my point is simple: anyone who told you to buy financial firms over the past one year as an investment didn't know what they were doing or needed a bag holder so they could dump their shares. Expensive lesson for some, but it is not too late to learn to turn off Cramer, stop listening to Ben Stein, cancel your subscription to Barron's and get out of the stock market after the next decent bounce higher unless you are a trader.

Yes, stocks are ultimately going lower - much lower. No, it will not be in a straight line. Yes, you should really buy some of that kooky physical gold to hold in your possession once the next decent price drop occurs (no I am not talking about the GLD ETF). And yes, the only stock sector that is in a bull market and the only one that will be for the next few years is the gold miners. I remain short and still believe a gold price pullback is imminent and you should NOT chase the gold price at these levels, as the risk to reward ratio is unfavorable.

Thursday, February 19, 2009

Unable to resist...

Autozone (ticker: AZO), that is. This is a stock I have been watching closely because I smell gravity getting ready to take this stock back to earth. This stock doesn't want to admit we're in a wicked bear market and denial is a powerful force. However, it can't last forever and I decided to take the plunge today when the stock got up near $143/share using June expiration puts.

Below is what I'm seeing and my rationale. First, a 3 year weekly chart to see the big picture:

Next, a 6 month daily chart:

Lastly, a 60 minute chart over the last 4 months to show why I got in around 143:

And how about a ratio chart showing the performance of AZO relative to the S&P 500?

This stock's going down hard. I don't think it will take much longer and when it breaks, it will be fast, hard and ugly.

Wednesday, February 18, 2009

Is Mr. VIX looking to cause some trouble?

'Cuz I get that sense when I look at a 6 month chart of the Volatility Index ($VIX).

It's amazing to me that we are threatening to break the November panic lows in the Dow and S&P and yet investors are much less "scared" now. This is actually a bearish sign. The more fear/the higher the $VIX goes, the less likely the downward move is sustainable. It looks like it's going to take a decisive break below the fall lows for the major indices to get people scared enough that the next bear market rally can get going.

This is peoples' adjustment to a bear market in real-time. A price that before seemed ridiculous no longer seems that way after a while. Remember $140 oil? Remember NASDAQ 5000? Now think the same thing in reverse. Think S&P 500 at 500 can't happen? Think gold at $2000 can't happen? Think again.

I think, at a minimum, the $VIX needs to re-test the highs made at the end of January (57.5 level) before we stop plunging - and it could easily go higher.

Tuesday, February 17, 2009

The hit parade chart-o-rama

Many new lows today. I was looking over S&P 500 charts of companies for names I recognize and checked a few hundred charts (yes, I need a new hobby). It was amazing to see the number of well-recognized companies in various industries that made new bear market lows today - below the fall lows.

WARNING: The following charts below may induce depression and/or stomach cramps among perma-bulls and could cause Cramer's head to explode. Without further ado, here's the bear hit parade as a continuation of my previous post (all 6 month charts):

Wicked bear - new victims

Don't try to catch this falling knife right now. Some 2 year charts follow - the new lows parade is in full force.

The Dow Transports ($TRAN):

The country of Spain ($SMSI):

The Swiss ($SMI):

Philadelphia Banking Index ($BKX):

Philadelphia Regional Banking Index ($KRX) - smaller banks are broke, too:

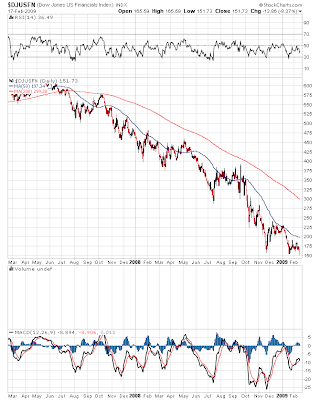

The Dow Jones US Financial Index ($DJUSFN) - destruction of the FIRE economy in progress:

Caterpillar (CAT) - a company that actually makes things of value:

Dow Chemical (DOW) - all I can say is holy shit:

Proctor and Gamble (PG):

It's getting ugly again and now is NOT the time to step in and be a brave bull while this bear rips out entrails and lays companies to waste. I remain short. Remember the 3 things I am looking for to start thinking about going long again, as they haven't changed and none of them has happened yet:

1) RSI down to 30 level/range on a daily chart of the $SPX

2) Put to call ratio ($CPCE) should reach or exceed 1.10 on a daily chart

3) The Volatility index ($VIX) should reach or exceed 55

By the way, these factors are just when I start to think about going long, not that I will automatically go long once these conditions are met!

Monday, February 16, 2009

Dow to gold ratio update

The dow to gold ratio continues to trend lower and is now under 9. I cannot stress enough how certain it is that this ratio will go below 2 and I believe it will fall below 1 on this trip into the basement.

This chart is my long-term road map and I will not be even considering selling any of my physical gold until this ratio is well under 2 and I will probably not seriously consider it until the ratio reaches parity (i.e. 1). If the deflationary collapse continues as anticipated, this will likely be at a gold price in the $1500-$2500/ounce range. Those that doubt, watch history in the making and learn something you can teach your kids and grandkids to use. This concept will remain valid until we learn from our fatal global monetary mistake and abandon fiat currencies.

Anyone who still thinks a ratio of 1 could not possibly be reached is in denial, has been living under a rock the last 6 months, or smokes too much happy crack. Staying in the stock market "for the long haul" is asking to have your money taken from you. Gold hasn't even reached the frenzy stage where the public stampedes into it, although fairly quiet institutional buying is already well underway.

It is definitely not too late to buy and hold physical gold as an asset protection mechanism. A current ratio just under 9 indicates that stocks have a long way to fall and gold has a long way to rise before parity is achieved. I still believe a a gold price drop is imminent and this will provide another great buying opportunity in the $820/ounce or lower price range. When it occurs, don't hesitate - BUY!

Sunday, February 15, 2009

HUI Gold Bugs Index

Or $HUI, is the favored index for gold bugs because it consists only of unhedged gold miners, who can benefit immediately from increased gold mining margins as they occur. You cannot buy the $HUI, but there is an ETF with ticker GDX that allows retail investors to get in on the gold mining sector and eliminate company-specific risk.

I was looking at stocks yesterday and tried my hand at Elliott Wave on the $HUI chart. I believe gold stocks (as a sector - of course, every individual stock is different) and the gold price are both due for a quick plunge before a spurt higher into spring.

If you're not into Elliott Wave, this stuff seems like voodoo and sometimes it is. It can be helpful at times when trying to figure out what may come next. Like most technical analysis tools, it must be used in conjunction with other analyses to improve a trader's odds, is not a magic crystal ball that always works and requires flexibility (i.e., must be willing to change wave counts if new price action dictates).

Anyhoo, below are my favored (top chart) and alternate (lower chart) wave counts on the $HUI action since the fall lows. Keep in mind that I am NOT a wave expert:

Either way, I remain short a few gold miners as a short-term trade and would wait to establish any new long/bullish bets in the gold patch. I like the first count better for a few reasons:

1. I believe the action since the end of December of 2008 has burned a lot of time without any progress (typical of a corrective phase) and a complex wave IV that takes 2 months would build a perfect set-up and base to allow a quick 4-8 week explosion higher (i.e. 50% gains or more from lows near the end of this month) in a wave V move to end this leg up of the new cyclical gold stock bull market.

2. It would fit better with the general stock market indices (e.g., S&P 500), which have been correcting since the first week of January. Gold stocks are not immune to general market forces. Remember, I am also anticipating a re-test of the panic November lows in the S&P 500 as a bear trap to end the month (to be followed by a rapid, high-powered bear market rally out into the spring).

3. Gold stocks have underperformed the gold price, as the $HUI has made no net progress since December 17th, while the gold price has moved to higher highs since this date. This is not bullish mining stock action and is more typical for a corrective phase.

Once gold stocks take one more quick plunge, which I anticipate will take about 2 weeks or so, I will be betting the farm on gold stocks by buying call options.

Subscribe to:

Posts (Atom)