Mr. Hugh Hendry is a successful hedge fund manager with a bit of a rock star aura in the financial community. He has a colorful personality and keen insights to accompany his track record of making good money for his investors. In a recent interview, he said the following:

"I am long gold and I am short gold mining equities. There is no rationale for owning gold mining equities. It is as close as you get to insanity."

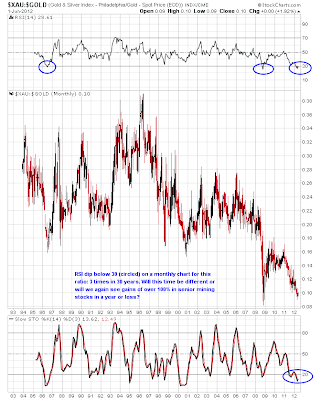

I want to thank Mr. Hendry for calling the bottom of the recent correction in the "Gold stocks to Gold" ratio. Because this was only a minor/short-term correction in a fledgling new uptrend in this ratio, Hendry's comment was not as powerful a contrarian signal as the plethora of articles on how crappy Gold stocks are relative to Gold that appeared last spring and summer (like this one). However, this recent comment sure is going to prove to be timely in my opinion. I would take the other side of Mr. Hendry's trade, but unfortunately I am long Gold as an investment and long Gold stocks as a speculation and don't see any rational reason to short Gold. In other words, I am talking my book just like Mr. Hendry, so take everything I say with a grain of salt. But I believe Mr. Hendry is going to get stopped out of his "long Gold, short Gold stocks" trade rather soon.

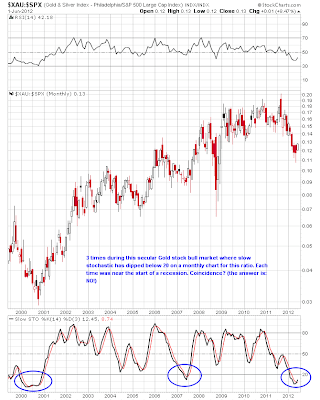

To be fair, Mr. Hendry also mentioned that he is long Gold and short the S&P 500, which is Gold Versus Paper's trade of the year, so we certainly see eye to eye on other issues. Gold stocks are set to go on a tear and I stand by my call that the GDX ETF will be at 80 by the end of May, 2013. That is my conservative target, by the way, and a triple digit price on GDX by then is not at all an unreasonable proposition in my opinion.

Here's the daily action of the "Gold stocks to Gold" ratio, using GDX:GLD as a proxy, over the last 8 months:

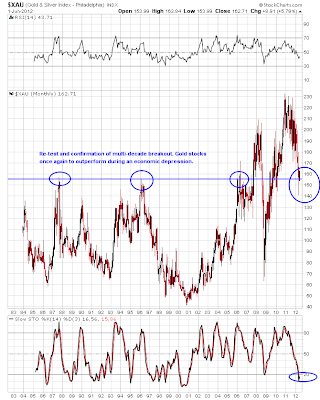

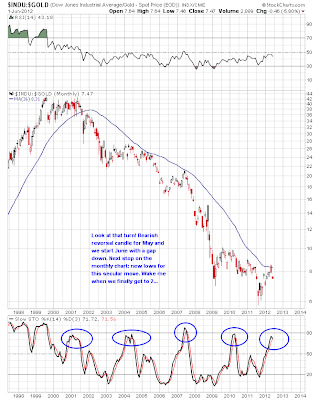

Of course, this is a shorter term consideration over the next few months or so, and ignores the bigger picture. Here's a monthly "Gold stocks to Gold" ratio over the past 30 years or so, using the XAU mining index as a proxy for senior Gold miners:

We just completed our third positive month in a row for this ratio. Today's Halloween action also suggests the correction in precious metals (PM) stocks is over. The silver stock ETF (ticker: SIL) has been relentlessly strong even during a steeper silver correction. The chart of the last 8 month's action shows the importance of today's volume on this early stage breakout higher, with the "silver stocks to silver" ratio (using SIL:SLV as a proxy) charted below to show the incredible relative strength of silver miners lately:

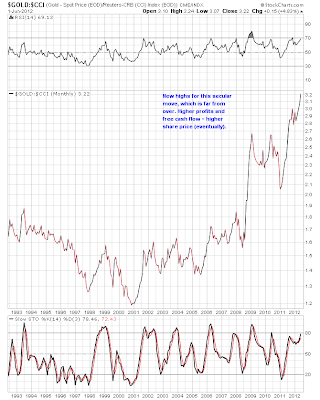

When Gold and silver stocks are leading their respective metals, this leads to the most consistent and the strongest cyclical bull moves in the PM sector for both the miners and metals (a la late 2000-2003, 2005-6 and 1973-1974). It is actually to the Gold stock bulls' benefit that Mr. Hendry and many other hedge funds are short Gold stocks right now, as their short covering will add fuel to the bullish fire. My subscribers and I finished buying into a new long Gold stocks position last week in anticipation of today's action and I continue to believe Gold stocks will outperform Gold over the next several months, though I expect both to continue rising.

For the very long term, I am a "Gold guy," not a "Gold stocks" guy, but the speculative opportunity in Gold and silver stocks right now is as good as it gets in my opinion (at least relative to the obvious bottoming this past spring and summer in Gold stocks).

If you are interested in speculating in the precious metals sector and would like some assistance, I run a low-cost subscription trading service that focuses on the shiny stuff and the companies that dig it out of the ground. A one month trial is only $15. Of course, there is nothing wrong with avoiding the speculative pool of sharks completely and simply holding on to your barbarous relics until the Dow to Gold ratio hits 2 (and we may well go below 1 this cycle).

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)