src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

There are no two ways about it: looking at current charts of not only Gold miners but also the general stock markets is downright scary right now. Many stocks in many sectors are deeply oversold and due for a bounce, but stock market crashes happen from oversold conditions. But I use technical analysis as a complement to the fundamentals and am not a "pure" chartist.

Particularly in the Gold market, which is manipulated just as much if not more so than many other markets, technical analysis can fail just when you need it most. In the end, all we retail investors are just guessing what will happen next in any market. The only comfort is that jp whore-gan and goldmun sucks apparently don't know what's going to happen next either, since they are only still in business thanks to American taxpayers. What a joke these guys and gals are! They have all the insider information, see what orders are coming into the market before everyone else, can withhold bids and offers at a whim, and they still get wiped out during a crash. If the "smartest guys in the room" (I use this phrase very tongue-in-cheek) aren't any good at knowing what comes next, what hope do the rest of us have?

Having said this, I have strong opinions on the markets, for better or worse. These opinions are based on a study of not only technical analysis, but also of market history and cycles that seem to recur based on human nature. Unfortunately for the other life on earth, human nature has not evolved much over the past few centuries.

We are in a secular credit contraction, or the prolonged bust that follows a boom like night follows day. The stock bubble burst in 2000 and the real estate bubble burst in 2005-6. Those looking to "buy and hold" in these sectors are making a losing bet when gains are calculated on inflation-adjusted terms. Of that, I am confident (unique individual opportunities aside). As a retail investor, my best chance is to be invested in a secular bull market to make money.

Gold is in a secular bull market that shows NO SIGNS OF ENDING. I don't care what Prechter says, this chart is a bull market with no, AND I MEAN ABSOLUTELY NO, chinks in its armor so far:

The Dow to Gold ratio is in a downward swing and the prior two downward generational swings suggest it won't stop dropping until we get below a ratio of 2. Could this time be different? Yes, but only because the Dow to Gold ratio could go below 1 this cycle given the extent of the excesses of the previous boom and the extent of the misguided central planner attempts to stave off the inevitable bust.

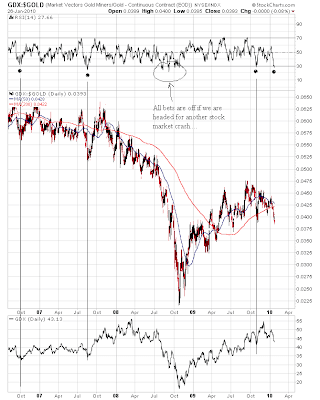

Fundamentals are very strong for Gold stocks as a sector. I am not a fundamental analyst for individual Gold mining companies - I don't have the background to do it. But as a sector, Gold stocks are the stocks you want to be invested in right now. Choosing to stay out of the stock market entirely for the next few years and sticking with the physical metal of the elite is not a bad idea. For those like me who are seeking speculative gains in addition to safety, however, risk is high and the likelihood of losses is much more than negligible over the intermediate term.

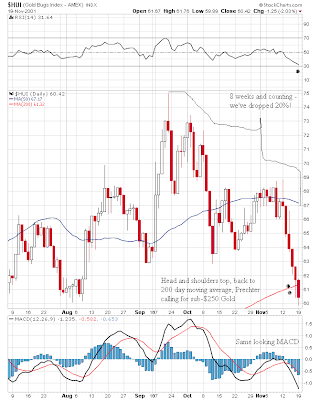

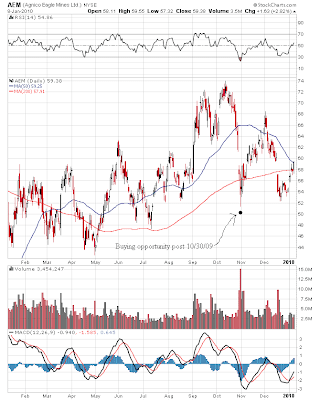

I remain bullish on Gold stocks, however, because of both fundamental and technical factors. Where one chartist sees a bearish opportunity, another sees a bullish one. I see a heavily oversold Gold stock sector, both relative to Gold and relative to its own chart internals. I don't think this is 2008 in the Gold patch, I think it is 2007 or perhaps 2001-2. Here's the summer of 2007 in real time as it felt to those in the Gold stock sector (60 minute intraday candlestick chart of the $HUI Gold Bugs' Mining Index):

And, of course, here's what happened next (daily candlestick plot of the $HUI):

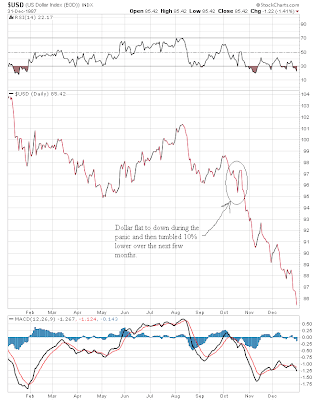

So, why am I confident that we are bottoming rather than setting up for a crash? Well, the benefit of the doubt belongs to the bulls first of all. Remember, too, that during secular Gold bull markets, stock bear markets are not an issue in the bigger picture. Fundamentals for Gold stocks are also excellent based on the "real" price of Gold or the price of Gold divided by the price of a basket of commodities (I use the $GOLD:$CCI ratio chart for this), a crude measure of Gold miner profit margins:

We are in a strong bull market for Gold and Gold stocks, fundamentals are supportive, and Gold stocks and Gold are oversold using basic momentum indicators. This is as good as it gets. No one can give you guarantees when investing, not even the inbred clods at goldmun sucks and jp whore-gan, and if they do then you should run the other way.

The other thing I like here is the behavior of platinum, which bucked ol' Uncle Buck on Friday and made a hearty attempt to re-start its powerful uptrend. Here's a 6 month daily candlestick chart of the action thru Friday's close:

I think we're due for a powerful snapback rally that should begin by the middle of this week. Don't get me wrong, I bought into this correction too early and I am down significantly over the past week in my speculative accounts. But I remain bullish here and less concerned than many "pure" chartists. Having said this, I expect Gold stocks to begin performing pronto (before the week ends for sure) and the character of the bounce will determine how long I stick around when it comes to my leveraged shorter-term option trades.