To me, the title is stating the obvious. To many, such talk is ridiculous. To

paperbugs, Gold is a bubble about to pop and only stocks make you money over the long haul. To paperbugs, capitalizing the word "Gold" labels me a tinfoil hat wearer, while to me, capitalizing the phrase "federal reserve" (not federal and has no reserves) is blasphemy. How supremely ironic that everything the ex-American presidents Jefferson and Jackson warned of when it comes to central bankstaz has come to pass and yet their countenances grace the $2 and $20 federal reserve IOU-nothing notes.

I am short the

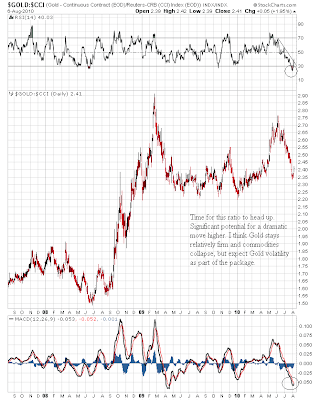

Dow to Gold ratio. It was the easiest and best trade of the last decade and it has much further to go - we will reach 2 and we may well go below 1 this cycle. Paperbugs scoff at such a notion just as they did at the turn of the century, but they have been so wrong they should be ashamed to prognosticate and comment on anything financial.

If you listen to the staff at mainstream media outlets (i.e. General Electric is now a bankrupt financier dependent on government largesse for survival), you just might be a sheeple. Cramer says "buy" because if he didn't, he'd be out of a job.

Ben Stein is ignorant and complacent because that's what he's paid to be.

Those who say the "stimulus" failed are as wrong as can be. It worked remarkably well in continuing the keiretsu fascist business model that now plagues the senior economies of the world. Corporations have stolen hundreds of billions from the taxpayer kitty and are ready to take more on the next market plunge - which part of success did I miss? At least China and Russia admit to central planning. Small businesses are screwed, which means Main Street is screwed. No small businesses, no real jobs. Government, Inc. is the only large corporation that is creating a significant number of "jobs" for people who actually live in America.

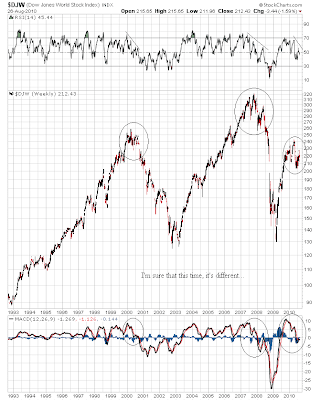

One can choose reality or not. Truth is difficult for most when it isn't rosy. I guess I am comfortable in being a bear. I am comfortable shorting America as a trade and investing in real money (i.e. Gold) during an economic depression. We can't possibly double dip when the first recession of this new economic depression/secular credit contraction/Kondratieff Winter never ended. But we can see lower real estate and stock prices. And we can also see lower commodity prices due to a weak global economy.

Gold is in a bull market. It is unequivocal on a long-term chart and anyone who says otherwise doesn't know how to read a chart. Period. You can call it a bubble if it suits your sour grapes, but the trend line has not been broken. U.S. government bonds are also still in a bull market, which is also unequivocal. How many Gold bulls feel comfortable with this latter comment? How many Gold bulls are comfortable with

Exter's pyramid? Hyperdeflation and hyperinflation are not as far apart as many like to think. Ice first, then fire, as federal reserve notes will be the last major asset class to hyperdeflate relative to Gold (the past deflation of private, for-profit, fascist, IOU debt notes backed-by-nothing relative to Gold has been just the warm up).

It is the monetary system that is breaking down. For those who think such tumultuous times will bring higher stock prices, I say "maybe." Ask Europe if a rapid currency decline relative to the rest of the world has been kind to their stock market over the past few years. Gold is money. Fiat paper backed by unpayable debt is a secular illusion that will be corrected by this secular equity bear market, which is far from over. No, you can't spend Gold at WalMart (yet), but you also can't eat T-Bills without a lot of hot sauce and mustard (

Gold is a delicatessen on the other hand).

Of course Gold will continue to go higher when priced in federal reserve notes during the current debt/credit collapse. Of course Prechter is wrong about what money you should be holding onto for dear financial life. The mainstream media wants you to be confused about what Gold is and so most are. Gold is a currency. Yes, it can rise during inflation, as can any asset (or any currency not being debased by apparatchik madness) during a generalized inflation. But during a secular credit contraction, confidence is lost in those who hold the reigns of power as well as those in the private business world. Where can one turn in such an environment?

Since we are already there (just not at the bottom yet for stocks or real estate), the answer is right in front of your eyes: Gold has outperformed fiat paper IOUs (whether Dollars or government debt), but fiat paper IOUs have outperformed stocks and real estate. Commodities are somewhere in the middle, but I wouldn't want to be worrying about peak resources just yet: global economic collapse has a way of slowing demand for raw materials and energy.

My positions are simple right now: long physical Gold and shorting the stock market. Right now, my interests lie with shorting the stock market, since my physical Gold just lays there, looking all shiny and what not while increasing in purchasing power every year like clock work. For those who scream confiscation, I can only give them a patronizing smile. More paperbug sour grapes for missing the boat. I would rather have a 99% tax on a gain than a 0% tax on a loss and I lost all my Gold in a poker game (to a Mr. Karl Denninger) if the confiscation order comes down from above.

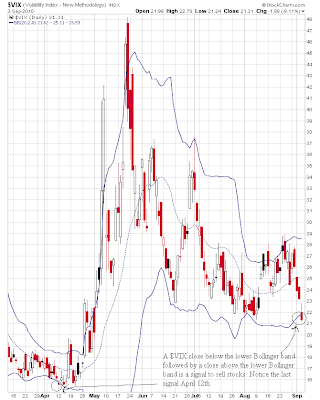

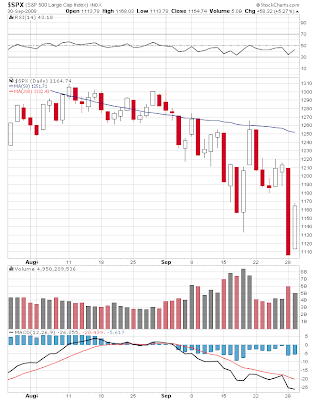

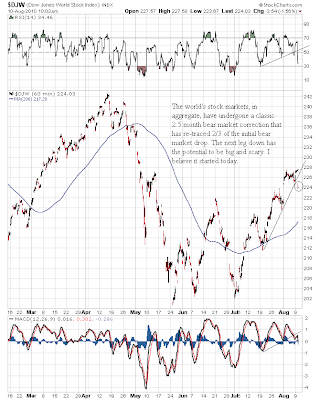

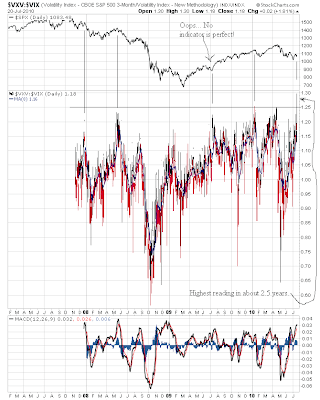

We are in a perfect position for a stock market crash and Friday's action did nothing to mitigate this. Yes, we may not get the big move until October, but an unconfirmed Hindenburg Omen on Thursday straddled by two near misses on Wednesday and Friday should make any seasoned trader willing to consider the evil bear side salivate, particularly in light of the hard economic realities lurking behind the financial markets. Stocks are

way over priced using traditional metrics. No, I am not talking about price to estimated future operating earnings and, yes, excluding mark-to-fantasy accounting - Japan tried this latter scam in the early 1990s to prop up their large banks and how's that working out for 'em? Even the

stars are aligned correctly for a major bear market move!

I remain with Richard Russell, Arch Crawford and

Ian Gordon on this one - a

hard rain's a comin' to a stock market near you, so batten down the hatches.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)