I am repeatedly asked how I can reconcile my belief that we have begun a deflationary depression with my belief that Gold is still in a bull market. As everyone supposedly knows, Gold does well during inflation but lousy during deflation. This is one of the greatest misconceptions ever perpetuated by Wall Street and Gold bug lore.

Wall Street either hates or ignores Gold most of the time with good reason. There's no growth prospects in Gold, no yield, and who needs a Wall Street analyst to buy Gold? Storing and handling Gold is also a pain. Gold is the antithesis of leverage. Having said all these things, even Wall Street is happy to oblige when demand calls via futures contracts and the GLD ETF. Wall Street's favorite disparaging comment on Gold relates to a theoretical person who bought Gold at its highest possible price at the peak of the Gold bull market that ended in 1980. This mythical investor, who picked the exact highest tick on the Gold price in 1980, had to wait until 2008 just to get back to even in nominal terms and what about inflation?

Valid argument. I have no quarrel with it. However, those same Wall Street people will not tell retail investors about those who invested in the Nikkei stock index at its peak in 1990 (down 76% as of today's close and it's been 19 years so far), those who bought the Dow Jones at the 1929 high (took 25 years to get back to even in nominal terms) and those who bought the Dow Jones at its highest point in 1959 (less than 10% gain 21 years later during a period of brutally high inflation).

Gold "bugs," on the other hand, who ought to know better, think Gold is a buy because the fiat money system will implode at any second and hyperinflation is imminent. They are always looking for a replay of the late 1970s bull run and think of Gold only as the anti-dollar. Such folks are also often into the commodity scene and are simply looking to flee paper fiat dollars and get into tangible assets.

Me, I'm a thinking man's Gold investor and I am much more worried about deflation than inflation right now. Yes, I know that inflation follows deflation like night follows day in a fiat system, but deflation first. This is the start of a credit and debt bubble collapse and such events lead to deflationary depressions (and Kondratieff Winters if you're into cycles like I am).

In deflation, cash is king as all other items decline in price and the purchasing power of money increases. The fiat currency of interest does well during deflation as it can buy more things. As the world's reserve currency, the U.S. Dollar should do better than every other fiat currency if this deflationary cycle plays out according to historical precedents.

So why am I into Gold? Why not just hold U.S. Dollars and forget about Gold? Well, there are several reasons, which I would like to detail individually, not necessarily in order of importance:

1. Gold is money. Gold is a form of cash just like a U.S. Treasury Bill is. I know you can't spend Gold at 7-11 but you can't spend a T-Bill at 7-11 either and yet they are both cash equivalents. The advantage Gold has over the U.S. Dollar is that Gold is not backed by debt and does not represent debt. Debt is bad thing to have hanging over your head during deflation as debt burdens become more and more oppressive as deflation grinds on. So, Gold is the only form of money on the planet (allow me to neglect other precious metals for now) available right now that is accepted world wide, is nobody's liability/promise/debt instrument and requires effort to produce so it is valued for its relative scarcity.

2. The U.S. Dollar will likely lose its status as the reserve currency of the world. This will be a geopolitical event, not an economic event. Economists and financial analysts often miss this point when they talk about the U.S. Dollar outperforming Gold during deflation. Deflation can be blown out in a heartbeat in the United States if the rest of the world starts using other means besides old Uncle Buck to settle the bulk of international trade. The demand for dollars is based not only on people needing to pay debts back in the currency the debts were contracted under but also because demand for U.S. Dollars is created by their use in international trade. The former demand should stay strong for a least a few years, but the latter has a cloudy future. Gold protects against this geopolitical event, which in my mind is an eventual certainty. Though I don't know what will replace the U.S. Dollar, I do know that Gold will benefit from the uncertainty and instability such an event would produce around the world.

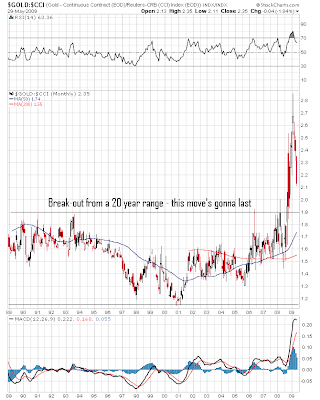

3. Even in a secular deflationary depression, there are periods of cyclical inflation. Economic activity will be weak and lethargic; asset bubbles have already blown out in oil, stocks, and real estate; and Gold has just emerged from the famous 28 year bear market Wall Street loves to point to, so "it's just time" (to steal a phrase from a recent Martin Armstrong piece) for Gold to have another bull market and any inflation that can be created in the next business cycle will at least in part flow into Gold. Gold has only gone up 4 fold since its bear market bottoming process during the 1999-2001 time period. After a 28 year bear market, don't you think it is reasonable to expect that Gold will manage to go up a little bit more than 4 fold before its current secular bull market is over?

4. Part of the big picture in my mind is that the global fiat currency system itself is what's failing. Many do not understand that when Nixon severed the final link to Gold for the U.S. Dollar, the planet embarked on its first ever global experiment in fiat currency, where no major currency anywhere in the world was backed by anything besides hot air and the foul promises of apparatchniks and their central bankstas. This experiment has failed in every society it has ever been tried in and for good reason. The power to create money out of thin air is a power that corrupts absolutely. The world is littered with examples from the famous Weimar Germany example to the Continental in the United States and the recent Zimbabwe example. Just because the experiment is larger doesn't mean human nature has magically changed and believe me, Helicopter Ben and widdle Timmy Geithner are not any smarter than those who came before them with the same goofy formulas, unshakable confidence and sheer arrogance. I think all currencies are sinking relative to Gold right now and the U.S. Dollar Index only compares the U.S. Dollar to other anchorless fiat currencies. Though many currencies may gain relative to each other or relative to stocks or real estate, I think they will all sink relative to Gold.

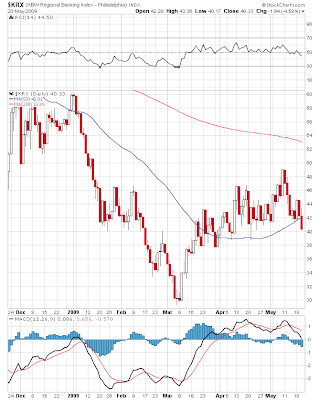

5. Trust is breaking down. In the U.S. and U.K., intentional lying and deception as well as outright theft are now being perpetuated against the citizens of these and other countries in the name of "saving" this or that or "stimulating" this or that. What percentage of people who follow financial markets actually believe the so called "stress testing" of the banking system in the U.S. was not an intentional deception designed to mask the reality of our financial situation from retail investors? When trust breaks down, Gold is trusted because it cannot lie or deceive and its value will not evaporate overnight or during a harried private Sunday morning meeting behind closed doors.

When trading with an electronic broker as most people do these days, how do you really know if you bought the stock your broker said you did? What if the government decides to confiscate 401(k) and IRA accounts to fund the Federal deficit, as they have already begun to discuss behind closed doors? What if you get caught in a trading position when the market shuts down for a day and stop loss orders don't fill at all? All of these risks are increasing as this bear market and economic depression for the record books grind on and these risks are no longer trivial. Physical Gold held outside the financial system protects against these risks.

6. Governments and their central banks own more Gold than anyone. Let me repeat this: Governments and their central banks own more Gold than anyone. If things get bad, these institutions can simply by decree declare that their Gold is worth $20,000/ounce and start the game all over again because they will still hold all the Gold/money. Think of 1933 and what Roosevelt did after confiscating everyone's Gold - he simply declared the Gold the U.S. Government stole was worth more than when they stole it! Yes, confiscation is thus a risk when holding Gold but things are much different than in the 1930s and few in the U.S. hold actual physical Gold. The GLD ETF, on the other hand, would be a great and easy way to confiscate Gold from U.S. citizens and thus I don't advise it for anything other than short-term trading for those who like to trade currencies without leverage.

7. Gold is a global market and is subject to global demand, yet it is quite a small overall market. It will only take a 1-2% shift of global asset allocation into Gold to cause huge price moves and as more and more people look to have their capital returned and kept safe rather than looking for a return on their capital, Gold will be an obvious choice.

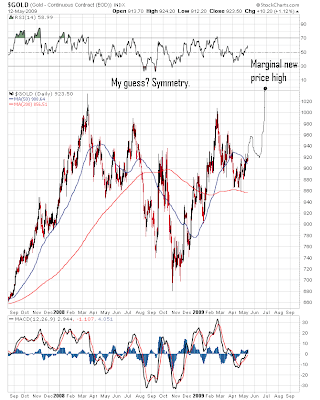

8. Recent price action has confirmed Gold's strength in the face of strong deflationary pressures. Gold is only off 10% from its all-time high versus oil being down 60% and the CRB Commodities Index being down 50%. Gold has also outperformed the U.S. Dollar since the current deflationary bear market began on October 11th, 2007. Using closing prices for Gold and the U.S. Dollar Index on 10/11/2007 and today (5/13/09) yields the following data:

Missing from this return data is the yield on U.S. Dollars. If we use roughly 3% per year interest for U.S. Dollar cash, the U.S. Dollar has returned closer to 10-11% since the bear market started. This still falls short of the return from holding Gold.

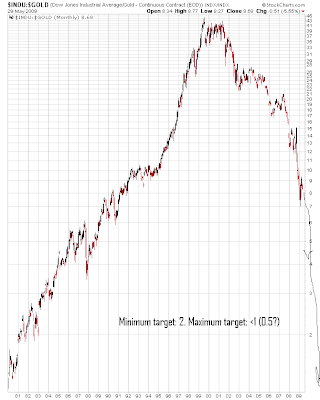

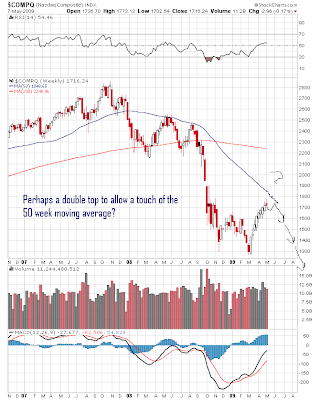

9. The Dow to Gold ratio. My favorite long-term chart. A thing of beauty in defining trust in financial assets versus lack thereof. Anyone interested in Gold should be aware of this chart and appreciate its implications. The version of this ratio chart that I like to use is from sharelynx.com (a great site) and is now a little outdated as it doesn't contain the most recent price action in this ratio, but it gets the point across:

This chart matters because most of us who read pieces like this one are people who have some of their money invested in the stock market. If the Dow to Gold ratio is going to 1:1 (i.e. the price of one ounce of Gold will soon equal the "price" of the Dow Jones Industrial Average), will you really be sorry you bought Gold if all it does is hang around $1,000/ounce and the Dow crashes to the 1,000 level? I won't because I'll be able to buy a heckuva lot more stocks in companies that were strong enough to survive the crash (i.e. not go bankrupt) than someone who "bought, held and prayed" for the next bull market in stocks. I personally feel the ratio has a good chance of going all the way back to 1:1 this cycle (we're at 9:1 as of the close 5/13/09) and this expected ratio reversion alone makes Gold a great investment relative to stocks.

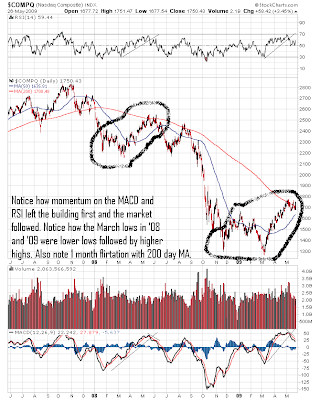

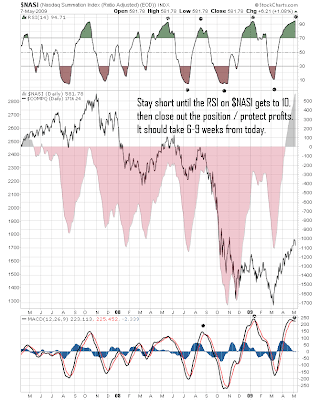

10. What else are you going to invest in that has such a rosy outlook? Look, if the commodity bull market comes raging back and the hyperinflationists are right, do you think I'm going to be bummed I own physical Gold? Gold protects against monetary crises, crises of confidence and government defaults/collapse. A monetary and/or credit storm, whether deflationary or inflationary, makes people turn to Gold for its stability. Breaking even is the best case scenario with stocks, real estate and corporate bonds right now and yet it is the worst case scenario with Gold! Now, some will argue that shorting the market is better or going long Gold stocks will make more money and I don't argue these points. I am into these investments as well. But Gold is the cash-equivalent anchor of my portfolio because bear markets are hard to trade even for long-term veterans and I want to have a margin of safety for at least some of my portfolio (see point #5 related to trading risks).

11. Gold is shiny and beautiful. I get a fever and I notice that chills run down my spine whenever I am near it. I want, no need, to get more. Hmmmm, maybe there is something to this Gold bug stuff...

[Article reprinted on goldseek.com:

http://news.goldseek.com/GoldSeek/1242306000.php]