src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

As the long term pendulum continues to swing towards Gold and away from paper, like it has many times before, central bankstaz are now getting in on the action. Every serious Gold investor is already aware that central banks are now net buyers of physical Gold. This is a critical tipping point in the almost decade old secular Gold bull market that is far from over.

On the one hand, you have the old guard American and British "powers that be" paperbugs that support the US Dollar fiat monetary standard. They know it, they control it, they profit from it. On the other hand, you have most of the rest of the world. When it comes to the Dollar, they acquiesce to it, they don't like it, and now that America is weak, they seek to dethrone it and make things more equitable.

Recently, an article came out discussing secret talks related to starting a new currency to deal in oil. It was immediately dismissed as psychopathic conspiracy wacko talk by multiple official sources. A few weeks later, of course, it turns out it was completely true. Here's a link to the article discussing it. Since “The US dollar has failed" and these oil producing countries "need to delink” from the Dollar (quotes from the article), they have decided to move ahead at a speed unexpected by those who denied such a thing was happening in the first place. Gotta keep the sheeple in the dark until the last minute, after all.

Let me clear about what this so called "Gulfo" (I bet a marketing firm was hired to come up with this awful name) means: the U.S. is going to lose its role as the reserve currency of the world and the international monetary system is going to undergo further major upheavals. The rest of the world (i.e. outside of the U.S. and UK) is already making preparations on how to conduct trade once the Dollar no longer functions in the role of reserve currency.

Now, why/how this is happening is open to speculation. In other words, such a plan would be a perfect part of the so-called banking cartel game to take over the world. First you support the creation of regional currencies, then you move to consolidate the regional currencies into a global currency. Regional currency blocks could overpower the weakened American Dollar, cause its collapse and force the U.S. into a regional currency (i.e., the "Amero" conspiracy theory). You can call it batpoop crazy talk if you want, or you can accept it as at least a possibility.

The alternative is simply free market-type chaos: different players gradually having a light bulb go off above their heads related to the now unsustainable path chosen by America and its bankstaz. Once the light bulb goes off that the game is up, you naturally would begin to prepare for a post-Americana monetary world. As an investor and speculator, it doesn't really matter why I believe these things are happening. The important point is that these events are happening.

Paper currency is a confidence game. Without Gold backing, why is one counterfeited paper debt note more valuable than another? The answer is confidence related to economic might, military might, the rule of law, political expediency/inertia and social mood. If people lose confidence in the Dollar and America further than they already have, the U.S. is in big trouble. Capital flows are a dagger that could pierce the hearts of Dollar-based deflationists like Prechter before the Dollar can see its meteoric rise into the heavens.

If the U.S. Dollar is not used to purchase oil, why is it needed to purchase or price any commodities that are not bought from the U.S.? If the U.S. cannot pay its debts except through more counterfeiting, why should countries send us their goods? Why should they lend us money? The Dollar-based deflation theory ignores capital flows. For in the absence of a Gold standard world, capital flight is the equivalent to a currency leaving the Gold standard as it causes the identical rapid monetary devaluation "event." Witness Britain in the 1930s, as the British Pound was the world's reserve currency going into the prior Kondratieff Winter/secular credit contraction/global economic depression (chart stolen from Martin Armstrong):

In the modern era, capital flight creates the same scenario for a currency as leaving the Gold standard used to do. The United States is so heavily reliant on external funding relative to the rest of the globe that a lack of willing global participation in its debt markets is a real possibility. Here's a chart stolen from the smart folks over at the GlobalEurope Anticipation Bulletin (GEAB), which they borrowed from Phoenix Project, to demonstrate this concept:

We have accelerated our debt offerings but we haven't proportionately accelerated our purchases of the rest of the world's goods to match the debt. Sounds like we are a dead beat customer to me! For now, it's quantitative easing filling the gap, also known as counterfeiting or playing chicken with the rest of the world. "Go ahead, make our day and punish our currency," the for-profit private federal reserve corporation says. As an aside, what could be better to turn their outrageous and illegal purchases of distressed real estate debt into a possible winner?

But beggar-thy-neighbor / "me too" policies means that other major countries (and minor ones, too) are trying to do the same thing. This "thing" (sometimes called "stimulation," "bailout," or "rescue") is currency destruction, pure and simple. This is why the US Dollar Index is not a good measure of purchasing power in an anchorless fiat paper currency world. Most people don't care how many Euros their Dollar can buy, they care how much food, gasoline and medicines they can buy with their Dollars.

Anyhoo, if the US Dollar loses its lynch pin status, what could possibly replace it? For those who say it can't happen, I would say it is now almost certain that the US Dollar is going to lose its reserve currency status at some point during this credit contraction, it is now really just a matter of timing and how it happens. I am a U.S. citizen and I do not consider this to be good news. But I deal in reality and I am grown up enough to handle the truth. Gold will protect people from this event when (not if) it happens. And if the government tries to block Gold ownership or Gold movement beyond the borders when it occurs, then one should be a true patriot and ignore the government. Such a currency event is not the end of the world, by the way, but it will catch a lot of people off guard, lower the American standard of living, and hurt those who trust the authorities to protect them.

More interesting to me than the fact that America will likely lose its monetary stranglehold over the globe during this Kondratieff Winter is the international game theory it introduces when it comes to Gold. I wish I could say that the sheeple won't accept another paper currency system to replace the current one, but I am not that optimistic. Regardless, when the deck re-shuffling occurs, who will come out on top?

If you are a central banksta, you have to hedge any bets or hunches you have. The struggle for monetary supremacy can create wars and serious trade conflicts, which are not always good for business (war can be, but it is risky if you finance the loser). Gold does not require a healthy economy to thrive, while all paper currencies are universally debased at the first sign of economic weakness.

China fired an amazing opening salvo by openly telling its citizens to buy silver and Gold, a first in the modern fiat world, and admitting that it has been buying quite a bit of Gold over the past few years. India jumped in and bought a chunk of the IMF's Gold to keep the game going. Russia tries to jawbone the market lower with false news of a sale then turns around and buys more Gold. Currency swap arrangements between Asia and other countries have already been hammered out to bypass the Dollar. And now some of the oil producers are starting a regional currency to use for oil sales, the confirmatory market signal of the end of U.S. Dollar hegemony.

Several central banksta participants need to buy as much as Gold as possible without causing panic or moving markets too much. Asian countries, including China, are under-invested in Gold relative to total reserves as are Brazil, Russia and India. If Gold is going to play a role in the new world monetary order, the BRIC nations need to buy quite a bit more.

When trust in paper breaks down, you want to own Gold as a basis for credibility if you are a central banksta. The more you own, the more credible you may end up being on the global stage when the new regime emerges. Hold enough Gold and people may offer you a seat at the bargaining table when the next scheme is hatched. Holding the paper reserves of almost any country right now is dangerous due to the uncertainty in the world right now. Fiat currency disruptions are going to get more intense. The Euro does not seem all that stable as a newbie on the currency block, especially since it hasn't been through a major test yet. The Japanese economy is the definition of a basket case. America is crumbling. If the world's largest three currencies are filled with uncertainty, where are you going to hide?

And if you have a secret desire to start the next currency regime, what better way to buy credibility than with a big pile of Gold behind you? As a country that is supposed to own quite a bit of Gold, how much would the U.S. be hurt by a high Gold price? In any event, the possibilities for the pending brave new world are enough to make a simple serf's head spin.

I do know that the majority of physical Gold holders right now are not exactly weak hands. Paper Gold holders are a fickle bunch, but those holding the actual shiny stuff in quantity will likely require quite the premium over current prices to part with it. So, up the price of Gold will go in fits and spurts as the big players scramble to turn in their paper for Gold at the best price possible. The first year of net central bank buying won't be the last, you can bet on that!

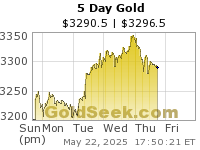

I'll leave the final word on banksta game theory to the bankstaz. Stick with Gold (and possibly Gold stocks if you have the stomach for it) for the rest of this cycle, which should continue at least until the Dow to Gold ratio hits 2 (and it may well go below 1 this cycle). We are currently at a strong and low-risk buying point for Gold (and many Gold stocks) in my opinion. Are you taking advantage of it?