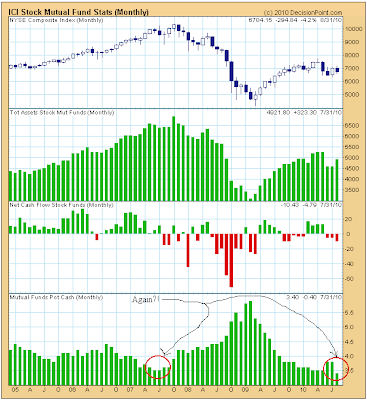

This chart should cause a sense of dread for all the retail investors left that are still still holding and hoping when it comes to general equities (chart stolen from a recent piece by Carl Swenlin):

Mutual fund managers, in aggregate, are like retail investors. There is no added value provided by these managers when reviewing this chart. Highest levels of cash occurred at the bottom, lowest levels of cash at the top. The August 2010 level is actually a record low percentage of cash over the past 5 years.

We are also set up to have a Volatility Index ($VIX) sell signal on stocks:

Equity put to call ratios remain at low levels for an equity bear market (i.e. levels that mark a stock market top, not a bottom). I think the current short squeeze will run out of steam this week, creating a significant top before a devastating plunge.

When it comes to Gold, I remain firmly committed to the long side via physical Gold that remains my largest holding. I am not interested in Gold stocks right now as I am skittish on all equities here. However, I am VERY bullish on Gold equities for the long term and hope to accumulate on weakness this fall. Gold stocks continue to underperform the metal, which keeps me in conservative mode and continues to make me think we are still in a consolidation phase for the short to intermediate term. I continue to think the U.S. Dollar is going to have another major rally to the upside this fall despite its horrible fundamentals.

I am still heavily short the S&P 500 via puts on the triple bullish UPRO ETF. The only changes I have made to this position are that I sold some puts as a hedge against my position and cashed this hedge out, using the proceeds to add to my short position on Friday. So, I am more net short now than I was a week ago.

When the mutual fund redemption requests start pouring in again on the next drop, mutual fund managers will have to sell significant amounts of stock due to their low cash positions. This, along with the lack of the uptick rule and the heavily computerized trading currently going on, will create an avalanche of selling this fall in my opinion. I think the herd will be forgetting about the confirmed Hindenberg Omen on the books at just the wrong time. Though I think we could have another up day or two this week, I am keeping my crash helmet on for the fall.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)