src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

Or perhaps not. Everyone thinks the U.S. Dollar is such a great "contrarian" play. But is it? Below is a Committment of Traders (COT) chart of the last 10 years in the U.S. Dollar Index. You can make your own at this great site (http://www.timingcharts.com/index.php). The top plot is of the U.S. Dollar Index, but the important plot is down below. This red linear plot below is of the "small speculators" aka "small specs" aka "dumb money" - the higher the red line, the more bullish small speculators are:

Remember that the big break of the 80 level on the U.S. Dollar Index a few years ago is catastrophic longer-term and 80 should now be resistance rather than major support:

I see confident U.S. Dollar bulls and nervous Gold bulls when it should be exactly the opposite! Oh well, markets never change...

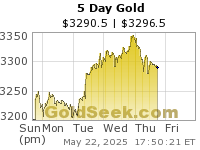

Of course, the U.S. Dollar Index is an ephemeral gauge of currency value when there is no anchor. A paper system backed by hot air and compared to other paper systems can have any arbitrary value assigned to it. Gold is the only worthwhile measure of the value of paper debt tickets (i.e. our currency). I think today's action strongly suggests that the bottom is already in for both Gold and Gold stock indices. I remain bullish on all things precious and metal.