src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

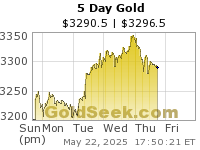

For newbies, that means I bought some 1 oz. Gold coins minted by the South African government aka Krugerrands. When we dipped below $1080 this morning, I couldn't help myself. I dipped into savings held in U.S. Dollars because I sensed value. I came to realize that I cannot go back to the other side of the Matrix.

I did a google search of "Krugerrand" and came up with 107,000 hits. I did a search of "Eurodollar" and came up with 198,000 hits. For those who don't know what Eurodollar means, check here. Our paper debt is more popular worldwide than the first government-sanctioned and minted Gold coin with no face value if Google is a reliable guide. This, of course, is pure paperbug insanity and now that I know what I know, I can't go back with the herd.

It is not anti-American to be pro-Gold. It is basic recognition of unsustainable trends and problems that are not going away. Our evolving fascist government (call it "corporatist" if you can't handle reality) will not stop until they are hung from trees. There is no end game except to screw the public and get as rich as possible. It's like 50 Cent and the G-Unit on heroin and steroids are running the country but with 5000 times the amount of firepower available to quell any dissent. The "average Joe" doesn't stand a chance unless they want to give up their job (if they still have one) and family and risk their life and liberty to rebel against the treason being committed at the highest levels of government.

The "free" markets always find a way to spank the guilty and weak. The unsustainable paper regime that began in 1971 when Nixon defaulted on the promises America made to the world is entering its terminal stages. The current international monetary system collapse will take longer than bears like me anticipate but it is inevitable. This does not mean the U.S. is screwed in the long term and it does not mean the end of the world. This is not doom and gloom for the prepared - it is opportunity.

The ideals of the U.S. have been subverted to a large degree (i.e. a central bank has impoverished the nation as Jefferson predicted, the Constitution is now routinely ignored, corporate lobbyists now write the bills pushed thru Congress, individual rights are no longer respected, etc., etc.). However, much like relative currency values are a reverse beauty contest, the U.S. still has a huge advantage over most of the world. We have one of the most vibrant and entrepreneurial populations on the planet, an abundance of natural resources, and a good heterogeneous mix of cultures. There is still a good chance for a renaissance in the United States.

I am not into the Armageddon scenario. I don't want to buy a log cabin, ammo to protect it and some freeze dried rations to eat in case the system breaks down. I consider myself a realist, not a pessimist. The Dow to Gold ratio is a pendulum, not a machete.

The American system needs to be fixed, but it won't be until things get worse - much worse. Complacency reigns despite the anger bubbling under the surface. I predict things will get worse for America and the rest of the world before good things can happen. America no longer deserves to print the world's currency, so the secular bear market in U.S. financial assets won't stop until the global market corrects this problem.

I realized today when Gold went under $1080 again that I no longer trust America to do the right thing to fix its problems. This is not a democrat or republican issue - a corporate whore is a corporate whore regardless of which corporation(s) he or she supports. Welfare, warfare or both is not a choice I am interested in making (I choose "none of the above" or "Ron Paul," whichever is available). Our government and its federal reserve keiretsu partner are the problem, not the solution.

Government can create jobs just like widdle tax cheat Timmy Geithner can tell the truth. Government can "stimulate" the economy just like a drug dealer can stimulate an addict, but why would we want such an unhealthy situation? Government can regulate the corporations who pay their campaign bills just like CNBC can be bearish on the corporations who pay to advertise on their network.

Gold is money and nothing else. It is a reality check on the insane clown posse that prints our funny green debt tickets. Our society is now literally dependent on further paper debt ticket issuance to prevent an economic collapse. A few people "at the top" can either turn off or on the monopoly money spigots and create "Prechterville" (i.e. hyperdeflation) or "Sinclairville" (i.e. hyperinflation) at their own whim and none of us has a say! Talk about "command and control"...

I choose Gold. I choose to opt out with a large portion of my savings until sanity returns. Now money market fund redemptions can be halted at the whim of any private company. The U.S. government (no, not Venezuela or Argentina) is now considering "helping" U.S. workers by switching their retirement money in 401(k)s and IRAs into government bonds "for their own good."

We are now at war with two Middle East countries that have never harmed us or done anything to provoke a military response against a sovereign nation. Before so called "patriots" get riled up, do they remember that most of the people on the "terrorist" list after 9/11 were from Saudi Arabia? Do they remember that we sponsored Bin Laden when he was fighting the Soviets? Do they really think that Bin Laden is something other than a government-sponsored boogie man feeding the military-industrial complex or do they think that a dialysis patient can survive in caves in the middle of nowhere for years on end?

I am now asked to remove my shoes and turn in my water when I go to a domestic airport, and I am not asked nicely. Do you see where I'm going with this? If you don't, read a few Martin Armstrong article that were written while he was (and still is) in prison for some vague financial crime that hasn't yet been proved (did you know America now has the HIGHEST PER-CAPITA INCARCERATION RATE IN THE WORLD?!).

As Armstrong says, capital goes where it is treated the best. Capital flows are an important part of the argument that make the deflation-inflation debate a little more nuanced than it seems at first glance. Will global capital rush into the U.S. during the next crisis or will it flow East? The answer is probably "yes and yes."

Paper currency volatility is set to increase, just as in the 1930s when the international monetary system last broke down. Last time it was Britain that sent the world into a tail-spin when it suspended its Gold standard. This time, we hold the reserve currency privilege and are doing everything in our power to abuse, exploit and essentially make sure we lose this honor. I think we can succeed.

When the storm is over and the Dow to Gold ratio is back below 2, I will start looking for opportunities to invest outside the Gold patch. I have given up trying to short the market for now, as shorting rules are changed on a whim and the printing press ensures that those with the power to manipulate markets in the short term (i.e. goldmun sucks and jp whore-gan) are given all the freshly printed money to paper over the rot in our system.

Much like the last time Gold dipped below $1080, I remain steadfastly bullish on all things precious and metal. Are you taking advantage of the buying opportunity before us in the Gold patch? If so, how? If not, why not?