src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

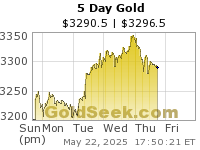

I don't need to tell anyone who concentrates on the daily squiggles that things have not been outstanding in the Gold patch the last month. If you are a true trader or investor, this is good news, since you should be adding more to your core positions on weakness. It is one thing to say "buy low and sell high," but it is not easy for most market participants to actually do it.

I am all in again from the long side and not worried about a thing. If the market moves against me on my call option trades, I'll take my lumps and move on. But I am patient here in all things Gold, as I know where the true bull market is right now.

Rather than review all the technical and sentiment reasons for why you should be buying Gold and Gold stocks here, instead, here's a few small rays of sunshine I saw in the Gold patch to end the week.

First up, Tanzanian Royalty (ticker: TRE) - [Disclosure: still long a big chunk of this stock and in my opinion only a fool would bet against Jim Sinclair during a secular Gold bull market]:

Next up, Everton Resources (ticker: EVR.V) - [Disclosure: still long this stock]:

Finally, Seabridge Gold (ticker: SA) - [Disclosure: no position, but still kicking myself for not buying this stock on weakness in late October]:

Keep in mind that these moves were supported by heavy volume and occurred on a nasty down day in the general markets. The GDX ETF managed to squeak out a tiny gain on Friday as well despite a slightly down day for Gold.

The Golden gloom is palpable out there in Gold land and totally misplaced in my opinion, but that's what makes a market. I am all in on Gold stocks and my physical Gold is still not for sale.