src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

As someone who holds a large percentage of my savings in a shiny piece of metal, I have learned to think in terms pricing goods in Gold. It is a foreign concept to all but the hard-core Gold bull crowd in the United States. Since you cannot use Gold or silver coins to purchase bread at the local store, paperbugs think this concept is silly and often mention eating pieces of metal and hiding out in log cabins when they speak of the only secular bull market left standing. Envy does create antagonism, no doubt (I believe the term "haters" is apropos).

But I am in this to protect savings and multiply wealth, not make friends with the Kool Aid drinking crowd. The retail sector has been on yet another tear lately and has made impressive new highs for the current cyclical bull market in general stocks. Here's a 6 month daily chart of the S&P Retail Index ($RLX) to show the recent action:

And here's a 7 year weekly chart to put things in perspective for the $RLX:

Still a long ways from the mid-2007 peak, but an impressive move higher over the past year, no doubt. However, this assumes that the measuring stick you are using to assign a nominal "price" to this index is stable. Let's take a look at the U.S. Dollar Index to see if this is the case:

So, I guess if we believe in the validity of the U.S. Dollar Index, then the currency has been stable overall since the mid-2007 peak in the retail index and thus the chart is valid as posted. But what if the U.S. Dollar Index is a meaningless concept? What if the international monetary system is backed by nothing but unpayable debt heaped upon unpayable debt? What if there is no anchor of stability for the monetary system? What if all paper debt-backed currencies are sinking together - how would the U.S. Dollar Index reflect such a situation? Well, actually it wouldn't and it can't.

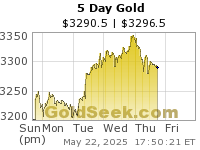

That's what Gold is for this cycle. Gold exposes the myth and fraud of our transactional paper debt tickets/currency units in this part of the cycle, just like real estate did the past decade and stocks did the decade before that. Defilement of the currency is an ongoing process. Since the business conditions are so weak and fragile at this point of the long-term economic cycle, Gold becomes the most reliable barometer of the declining value of currency units and the go-to asset class.

Let's look at the S&P Retail Index again, but this time priced in Gold (i.e. $RLX:$GOLD) over the past 7 years:

Gold has not gone up in value significantly over the past 10 years, but our currency has been debased and defiled aggressively over the past decade. When confidence declines and we run out of "hot stories" in traditional markets, people turn to real tangible assets to protect their wealth and the value of their savings. When you live in a world with an unstable currency, you are a casino patron whether you like it or not if you want to preserve the value of the money you have worked for.

Gold works best in this part of the cycle because the economy is in tatters. The secular bear market in general stocks and real estate has a long ways to go when priced in Gold and also when priced in the value of today's U.S. Dollars. If the inflationist experiments succeed for another round, then we could hit nominal new highs in the general stock market indices that reflect a massively declining value of the U.S. Dollar.

In this case, Gold is going to $6,000/oz or higher and will trounce the gains in the stock market. If we are going into the deflationary collapse scenario, then Gold holds it value in the $1000-$1500/oz range and the Dow Jones Index declines to terrifying new lows well under 5,000. If we are going to muddle through and find a middle ground, then Gold peaks somewhere in the middle of the two extremes and outperforms the stock market by a wide margin. Getting the theme here? The Dow to Gold ratio is going to 2 and may well go below 1 this cycle. Until this bottoming process happens, Gold is good and stocks are bad. The Dow to Gold ratio doesn't tell you what the peak Gold price will be, but it tells you when it's OK to stop hiding in your Golden log cabin.